Credit Cards: Align your Marketing with Customer Lifecycles

The beauty of marketing credit cards lies in the unique dynamics of the product. Anticipate and address these dynamics and you can continue deriving income from the same customer over a lifetime.

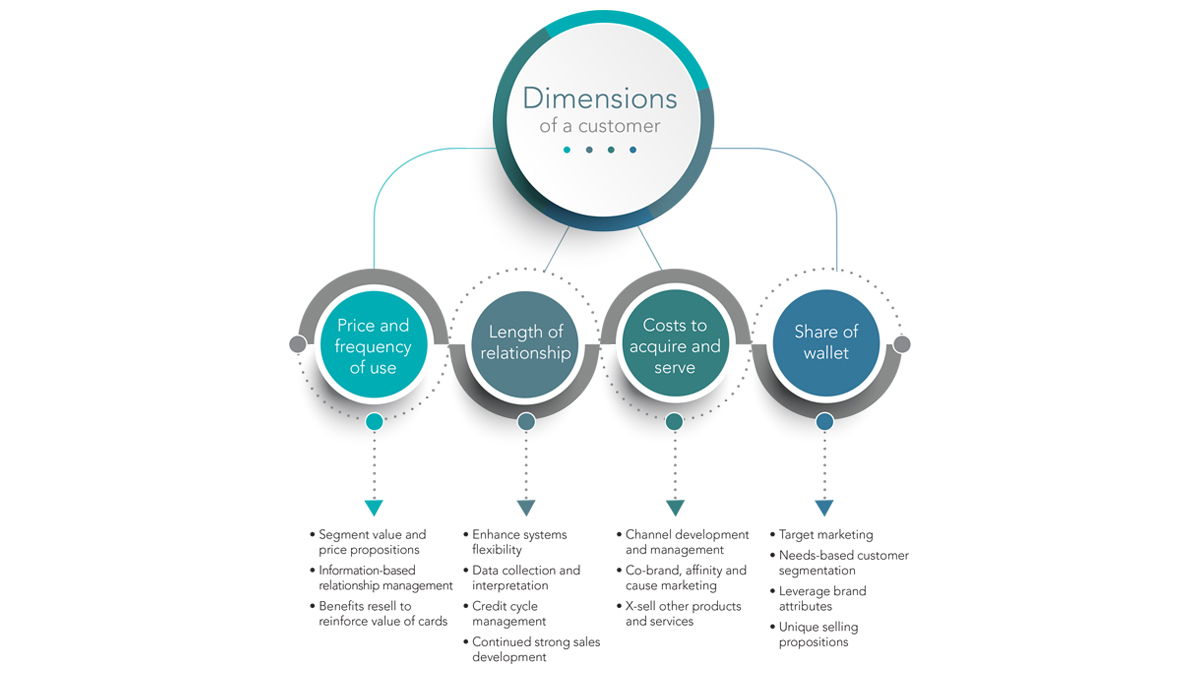

Creating and Measuring Value

In any industry, you can’t create value unless you understand what the customer needs—and how to satisfy that need at a price that’s both acceptable to the customer and profitable to the company––all before your competitors beat you to it. That means supply and demand management are crucial.

The 4 Es: Adding Fuel to the Marketing Mix

For more than half a century, marketers have relied on the 4 Ps of marketing, a framework first written by E. Jerome McCarthy in his book Basic Marketing: A Managerial Approach. McCarthy’s formulation, which includes price, product, promotion and place (distribution), has informed the bedrock of product and marketing management since 1960.

Rediscovering the Sheer Power of DM

Fashionistas know the drill: what’s out of fashion has a way of roaring back when conditions change. Today we’re seeing a similar resurgence in direct mail—a medium that had been written off prematurely as a relic. Not anymore. A decade ago, digital marketing, a then-emerging alternative for reaching massive numbers of inboxes, started attracting attention and dollars. It quickly supplanted direct

Showcasing Creative Solutions in Places That Matter

Headed to FICO World 2018? We are. Scheduled for April 16-19 in Miami Beach, the event is the leading international conference on advanced analytics and decision technology. From artificial intelligence (AI), machine learning and analytic innovation to customer acquisition, growth and retention and collections and recovery, to decision management, scoring strategies, and Cybersecurity, FICO World 2018 is the place to be.

How to Engage Your Customers and Improve Collection Rates

As long as debtors have been late with payments, collections activities have largely followed the same basic script: Ask nicely, ask forcefully, demand, threaten, charge-off. Most creditors rely on outbound calling strategies to do the heavy lifting and simply view their letter strategy as a compliance tool.

Blog

Copyright © 2025. A De Novo Corporation company